danbury tax bills|EB2Gov PropertyTaxes : Tagatay Revenue Bill Search & Pay - City of Danbury. City of Danbury: Account info last updated on Apr 3, 2024 0 Bill(s) - $0.00 Total: $0.00: View Cart | Checkout. Home . According to PHLPost, Cavite has a total of 46 zip codes or postal codes, ranging from 4100 to 4135. The zip codes or postal codes in Cavite are based on the geographic location of the municipalities and cities. Generally, the zip codes or postal codes start with 41, followed by two digits that indicate the specific municipality or city.

danbury tax bills,Revenue Bill Search & Pay - City of Danbury. City of Danbury: Account info last updated on Apr 3, 2024 0 Bill(s) - $0.00 Total: $0.00: View Cart | Checkout. Home .With our new user-friendly software, you can pay your property tax and water/sewer bills online. In addition to electronic payments, you can also pay your taxes at your local .

Tax Payments. How can I pay my taxes? Payments will be accepted at the Office of the Tax Collector, City Hall, 155 Deer Hill Avenue, Danbury, CT from 7:30 am to 6 pm, .

Tax Payment Options. View & Pay Property Taxes. Pay Water & Sewer Bill. DMV site. Tax Assessors Office. TaxServ Capital Services. About Us. The Tax Collector’s Office is .EB2Gov PropertyTaxes. Danbury. Property Tax. Tricia J. Taylor. 603-768-5448. [email protected]. Danbury Services. Property Tax. Please follow the .Only current taxes may be paid at the bank branches. Delinquent taxes may not be paid at any bank branch. You may not pay water and/or sewer taxes at the bank branches. .danbury tax billsOnly current taxes may be paid at the bank branches. Delinquent taxes may not be paid at any bank branch. You may not pay water and/or sewer taxes at the bank branches. .Sign In. When using an existing account, you will be redirected to the CivicPlus sign in page. Engage your community – connect to news, events and information you care about. Current Year Taxes - Due Dates. Grand List 2022 Mill Rate 23.33 . Real Estate, Personal Property, Downtown DistrictThe City of Danbury’s Treasurer is elected every two years to this office. The duties of the Treasurer, as defined by the City Charter are: The Treasurer shall have custody of and .Personal Property | Danbury Assessor's Office, CT. Home. Personal Property is tangible property (other than real estate) used in businesses. Examples include, but are not .

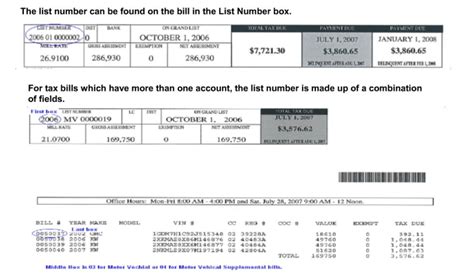

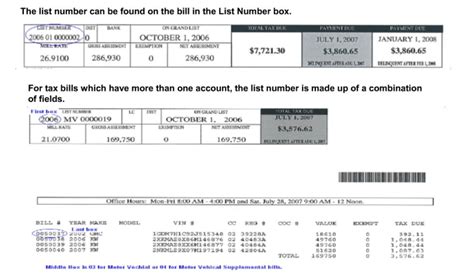

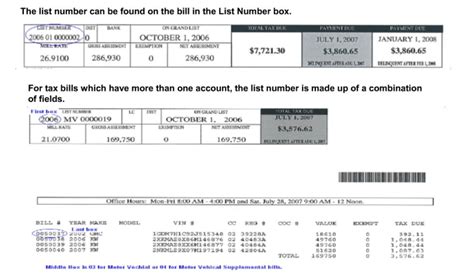

City Deferral Program. To Qualify for this program you must have been a taxpayer to the City of Danbury for a minimum of five years. All income limits are Gross (prior to any allowable deductions) Single Income Limit $52,500. Married Income Limit $59,200. Benefit: 25% of Real Estate Taxes with a lien of 5% per year (maximum net assessment $300,000)Motor vehicles registered on October 1st will be part of the October 1st Grand List and will generate a tax bill in July the following year; When you receive a tax bill, the bill is for nine months behind and three months ahead; . Danbury, CT 06810. Phone: 203-797-4556.danbury tax bills EB2Gov PropertyTaxesIf you moved from the City of Danbury but still received a tax bill from the city it is because DMV had your vehicle registered with Tax Town 034 as of October 1st. DMV may have changed your mailing address but not your Tax Town Code so you should check your registration to verify. If you moved out of state, pursuant to section 12-71c of .The Tax Collector’s office is located at Wilton Town Hall, 238 Danbury Road, Wilton, CT and office hours are Monday-Friday from 8:30 am to 4:30 pm. If you pay by check please make all checks payable to Tax Collector, Town of Wilton, if you are not including your payment coupon with your payment, please include your bill number on the memo line.If you received a tax bill for a vehicle you are no longer in possession of, it is because the vehicle was still registered as of October 1st. If this vehicle was sold, totally damaged, stolen and not recovered, or removed and registered in another state you may be entitled to a credit off your tax bill. . Danbury, CT 06810. Phone: 203-797-4556.

You must bring the entire tax bill when making the payment. One receipt will be returned to you and the other forwarded to the Tax Office. Savings Bank of Danbury - 100 Route 37; Union Savings Bank - 24 Route 39; New Fairfield Town Hall | 4 Brush Hill Road, New Fairfield, CT 06812 | (203)312-5600 • TDD (203) 312-5603 .

The Tax Collector’s Office is a division within the City’s Department of Finance and its primary responsibilities are governed by the State of Connecticut General Statutes and the City of Danbury Ordinances. Under these statutes and ordinances, the Tax Collector mails approximately 200,000 tax and utility bills and notices annually.

The Assessor’s Office has the responsibility of assessing every taxable and exempt property located in the City of Danbury and compiling these assessments into the City’s Grand List. Included in the Grand List are real estate, business personal property and registered motor vehicles. In doing this, we ensure that every property owner is . “My 18 residential properties under the previous assessment were assessed at $3,750,438 and my tax bill for the city of Danbury was $105,837,” Sousa said. “The new assessment of my 18 .In no event shall Burnett County become liable to users of this data or any other party, for any loss or direct, indirect, special, incidental or consequential damages, including but not limited to time, money or goodwill, arising from the use of property tax and land record data. The data contained herein are a matter of public record.City of Danbury 155 Deer Hill Ave Danbury, CT 06810 Phone: 203-797-4500 City Hall Hours. Monday - Wednesday. 7:30AM to 6:00PM. Thursday. 7:30AM to 6:30PM. Friday. ClosedPay Tax Bill; Property Tax Search; Public Safety Information; Pay Water Bills; How Do I. Board Appointments; Commissioners (Meeting Information) Department Directory; Holiday Schedule; Job Opportunities; Marriage License; Ordinances; Surplus Property; Community Links. Town of Danbury; City of King; Town of Walnut Cove; Tourism; Danbury Library .

If you do call the Tax Collector or Assessor’s office, you will be directed to TaxServ. TaxServ Capital Services, LLC can be reached at: Telephone: 860-724-9100 Fax: 860-727-1080 site: TaxServ.com. View Tax .

EB2Gov PropertyTaxesDanbury, NC 27016 Office Hours: 8:30am - 5:00pm Monday - Friday Richard Brim, Director [email protected] Search and Pay Taxes: Click Here 2020 Online Listing Service: Click Here New Public site: Stokes County Tax Administration Land / Home Values Property Record CardsPay My Taxes. Tax Collector. Contact Us. Assessor's Office. 155 Deer Hill Avenue. Danbury, CT 06810. Phone: 203-797-4556. . Danbury. CT 06813 Phone: 203-797-4541 Fax: 203-796-1547 Office Hours. Monday thru Wednesday 7:30 am to 6 pm. Thursday 7:30 am to 6:30 pm. CLOSED FRIDAY. TaxServ Capital Services;

You can combine selections like Residential Property Use and a location like Main Street. If the search by owner is available, you may want to enter only the last name such as Smith instead of the whole name due to how properties are registered in the Assessor's Office. If you don't select an item then it defaults to all.If you received a tax bill for a vehicle you are no longer in possession of, it is because the vehicle was still registered as of October 1st. If this vehicle was sold, totally damaged, stolen and not recovered, or removed and registered in another state you may be entitled to a credit off your tax bill. . Danbury, CT 06810. Phone: 203-797-4556.Tax Services Danbury CT. A Tax Center LLC is a home based business. You can come to us (and visit with the cats), or we can go to you if you live in the area. We receive information for distance customers via e-mail, fax, the US Postal Service, and FedEx and send completed returns as the customer requests. Connect with us on LinkedIn.

danbury tax bills|EB2Gov PropertyTaxes

PH0 · Treasurer

PH1 · Tax Payments

PH2 · Tax Collector

PH3 · Personal Property

PH4 · Pay Your Taxes

PH5 · My Account • Danbury Assessor's Office, CT • CivicEngage

PH6 · FAQs • How can I pay my taxes?

PH7 · EB2Gov PropertyTaxes

PH8 · Due Dates

PH9 · City of Danbury, Connecticut

PH10 · City of Danbury